This has been on my mind for some time, as I am a customer and reseller of Cloud Sites. I think the simple explanation is like how Steve Jobs explained the difference between Desktops and tablets: “Trucks vs. Cars.”

Cloud Sites, while being very powerful and very scalable, are more for serving content. This blog post you are reading is being served by Cloud Sites, running WordPress. WordPress and other “CMSs” (Content Management Systems) are perfect for Cloud Sites, being astonishingly easy to use, while being powerful enough to handle all the traffic you can send to it, without crashing.

Cloud Servers is more for websites that are designed as services. While being perfectly capable of running WordPress and content, for that type of application, Cloud Servers may be overkill, as well as being more technically difficult to set up and maintain (One of the many benefits of Cloud Sites is that all of the technical stuff is actively maintained and managed 100% for you). A services type website (Think Twitter, Facebook, an Online Photo Editor) is a destination people go to do some type of application in the “Cloud” as it were as opposed to running it on their own computer. Yes, I know, Twitter and Facebook are places where you consume content, but they are also services where you create content (in these cases to share). So simply put, “Services” websites are like computers in the Cloud, where a lot of computation power is needed to provide a computational “service” and then output into and from the Cloud.

So if you have a website designed to inform or display content, go Cloud Sites. If you are planning a computational intensive website, that’s designed to be more of a service to your visitors, Cloud Servers is probably your best bet.

————————————————————–

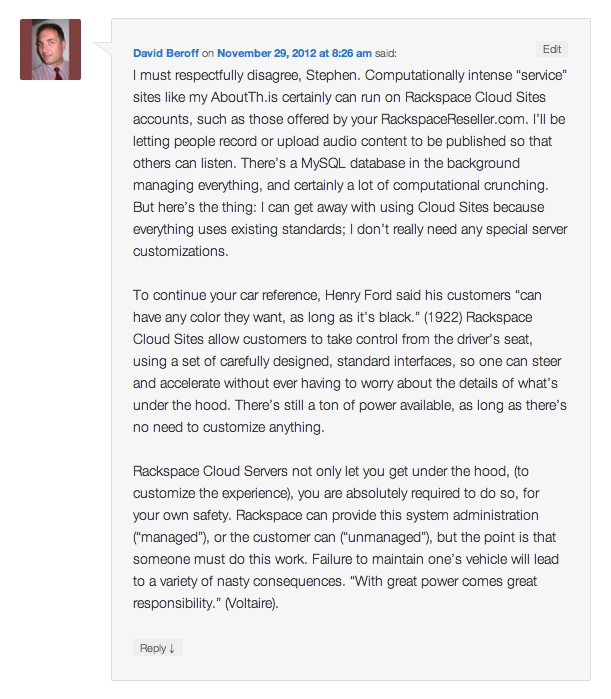

Since this blog post was originally written and published on RackspaceReseller.com/blog which was a domain I originally ran, but had to take down, I made a photo copy of the one comment that was originally on it before I moved the post over here. Here the photo of the comment: